Airbnb Apartment Investment

You don’t need to buy an apartment in order to profit from tourism real estate, Passively invest in Airbnb arbitrage and earn the high margin between the long-term rental sector and the short-term tourism sector - With our full management

Rapid expansion potential

|

Suitable for investors with no Airbnb experience

Deal entry barrier: €15K–€20K

|

Rapid expansion potential

Suitable for investors with no Airbnb experience

The Model is Simple

We source and analyze smart apartment investments, designed to generate significant profit from the gap between the rent paid to the owner and the income from Airbnb. We sign you to a direct contract with the local property owner, and, if needed, take care of design and renovations.

Already within a few weeks, we start transferring income directly to you from short-term rental platforms (Airbnb, Booking), while handling everything – Guest communication, cleaning, maintenance, profile management, and reviews. We operate as a “black box” that turns every guest accommodation into steady cash flow for you.

I’ll show you how to take a savings amount of €15,000–€25,000 – and grow quickly by scaling your rental operation – all while managing risks and ensuring high, secure returns.

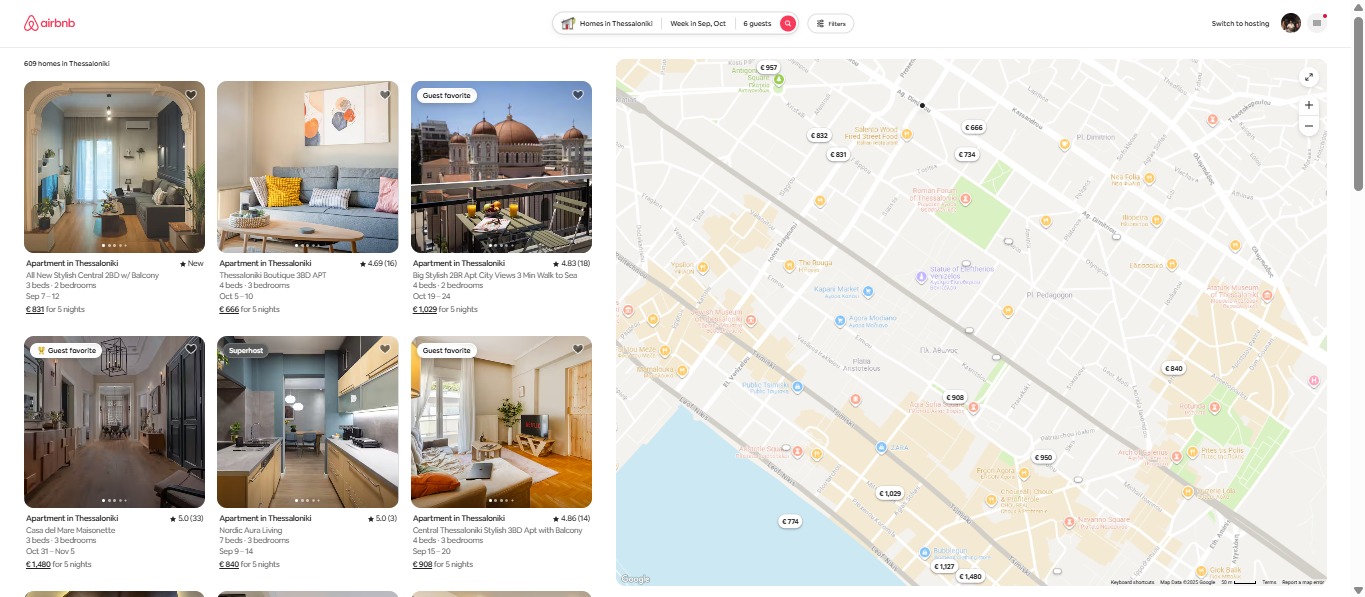

Why Athens / Thessaloniki?

Because I’ve been working there for years, with strong professional connections to a local law firm specializing in Foreign clients, as well as to a trustworthy accounting office who understands the operational and financial side of property management. It goes without saying that we’ve got our own management, cleaning and maintenance.

Advantages of Athens / Thessaloniki:

- Vibrant urban life - Cities with tourism year-round, in every season

- Financial advantage for foreigners - with relatively low rent and expenses, and a welcoming attitude toward foreign investment

Who Am I?

I’m a Computer Science graduate who could have pursued a high-paying career in tech, but I couldn’t stand the corporate life. So I opened a property management business. During that time I learned everything there is to know about running an Airbnb operation (and Booking.com – we maximize demand and profit, yes?).

that doesn’t change the fact I’m a numbers guy — I dive deep into the data to maximize results

One last thing – I’m not going to lie to you at any point – I can’t promise that your first property will generate €1,400 profit per month, like the one I show in the video. It depends on a variety of factors – including your own decisions. If you follow me, you can definitely own a fleet of highly profitable apartments (especially in terms of yield, meaning relative to investment) managed by my employees and under the professional umbrella I’ll provide.

Case Study: Edan’s Apartment

(Who continued with 2 more)

We found Edan’s apartment for him mid-2023. He invested €7,000 in furniture and appliances, plus another €1,800 for first rent and deposit, which will be returned when he returns the apartment to the owner (we secured him a contract with a 7-year option, low rent increases, and the owner’s willingness for continuity).

It’s also easy to read between the lines and see that Edan’s rent is €900 per month. Let’s quickly review his other expenses – electricity and water: €150, management, cleaning with laundry and maintenance: €500.

His average monthly income from Airbnb combined with Booking.com is €2,700. These figures are calculated after the commission taken by the platforms.

Edan earns an average profit of €1,150 per month. This means that after just 7–8 months, Edan had already recouped all of his initial expenses (mainly furniture and appliances – which belong to him anyway), and from that point on he began remotely managing an apartment that increased his earnings by €1,300 per month.

He later expanded with two additional apartments, each generating a profit a bit smaller than the first – around €1,000 per month.

Program Structure

The sessions will include learning and review of the following topics:

Session 1

This session will focus on analyzing the activity that best suits your needs and preferences – in terms of budget, apartment size and furnishings. In addition, an explanation will be provided about the property rental process, the required registration, and general key points on the subject, including the negotiations we conduct on your behalf. At the same time, I will begin presenting you with options for apartments available for rent.

Session 2

(Virtual / Phone)

At this stage, an analysis will be conducted of the necessary adjustments to the apartment, with an emphasis on furniture and equipment – aimed at maximizing the potential profit on platforms such as Airbnb and Booking. The adjustments will be made according to the investment you are willing to make (usually in the range of approximately €7,000–€10,000). During the session, we will discuss which furniture is essential and what can be skipped, and how this impacts the apartment’s pricing and its ranking in search results.

Session 3

At this stage, after linking your bank account to the property profiles, you will already have an active property generating income on the platforms. Professional photos of the property will be presented after full furnishing and styling.

Session 4

A final meeting after the operation has begun. We will analyze guest feedback, and assess what adjustments are needed to improve the apartment’s performance and profile on the platforms. In addition, we will address questions that arose during the period, and present final guidelines to continue the independent operation of the property.

Client Apartments

Before & After

Almog's Apartment:

Dvir's Apartment:

Samer's Apartment:

How Does It Really Work?

A final meeting after the operation has begun. We will analyze guest feedback, and assess what adjustments are needed to improve the apartment’s performance and profile on the platforms. In addition, we will address questions that arose during the period, and present final guidelines to continue the independent operation of the property.